Credit Scoring Project for Credit Match

Background: In the face of the rapidly evolving financial market and the increasing demand for transparency from clients, Credit Match sought our expertise to develop an innovative credit scoring solution. The goal was twofold: to optimize the credit granting decision process and to enhance client relations through transparent communication.

Proposed Solution:

- Automated Scoring Model: We crafted an advanced classification algorithm that leverages a myriad of data sources, including behavioral data and information from third-party financial entities. This algorithm is adept at accurately predicting the likelihood of a client repaying their credit.

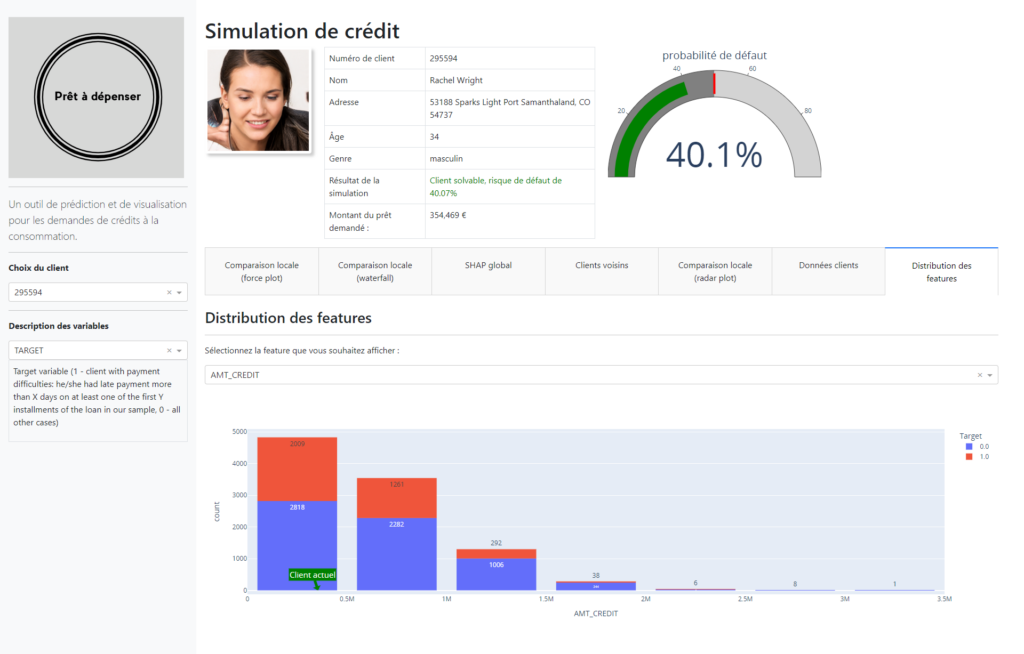

- Interactive Dashboard: Addressing the need for transparency, we designed an interactive dashboard tailored for client relationship managers. This dashboard not only elucidates credit granting decisions but also provides clients with easy access to their personal information.

Technologies Deployed:

- Analysis and Modeling: We utilized Kaggle kernels to facilitate exploratory analysis, data preparation, and feature engineering. These kernels were adapted to meet the specific needs of Credit Match.

- Dashboard: Based on the provided specifications, we chose [Dash/Bokeh/Streamlit] to develop the interactive dashboard.

- MLOps: To ensure regular and efficient model updates, we implemented an MLOps approach, relying on Open Source tools.

- Data Drift Detection: The evidently library was integrated to anticipate and detect any future data discrepancies, thus ensuring the model’s long-term robustness.

Deployment: The solution was deployed on [Azure webapp/PythonAnywhere/Heroku], ensuring optimal availability and performance.

Results: Our model demonstrated outstanding performance, with an AUC exceeding 0.82. However, we took precautions to avoid any overfitting. Moreover, considering Credit Match’s business specifics, we optimized the model to minimize costs associated with prediction errors.

Documentation: A detailed technical note was provided to Credit Match, allowing for transparent sharing of our approach, from model conception to Data Drift analysis.